06|2021

You’ve most likely heard this term thrown around in relation to credit card processing, but what exactly is interchange and why does it matter? Interchange is the individual price assessment for all card types; since these fees are paid directly to the card-issuing banks, not to the payment processors, they are generally non-negotiable and can be quite hefty. Understanding how these rates are calculated and what you can do about it is simply savvy business practice!

What is Interchange?

Interchange is the pricing schedule that each Card Association (Visa, Mastercard, Discover, Amex) assesses for every variation of card they create based on risk. Since risk varies depending on industry type, for example a furniture store is more risky than a restaurant because of longer time frames from payment to delivery of the product, naturally higher risk, interchange rates reflect that. There are hundreds of cost structures depending on factors such as the industry, card type, and transaction size.

The tricky part is that these rates are not static. Because these rates are based on the risk associated with a particular card variation, credit card companies are regularly adjusting the fees. Visa and Mastercard change their rates twice a year. Additionally, the risk assessed depends on what type of card is issued. Debit cards have lower rates than credit cards because of a lower credit risk (funds are debited directly from a cardholder’s bank account). Credit cards, especially business cards and rewards cards, have higher rates to fund the programs provided to the cardholders.

What is Interchange Optimization?

CardConnect offers Interchange Optimization for business-to-business and business-to-government merchants through the CardPointe platform. This program obtains the best possible rates for Level 2 and Level 3 purchasing cards by automatically populating extra details about the transactions. Most transactions collect Level 1 data when processing a payment, such as a cardholder’s billing address. Level 2 and Level 3 data gives more information such as customer codes, PO numbers and tax IDs. The more data gets filled out, the lower the risk of fraud and the lower the Interchange rate!

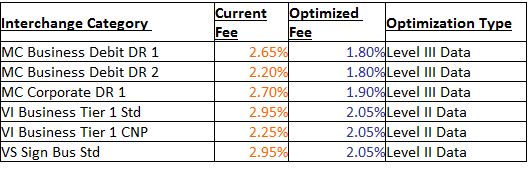

As you can see from the example above, the Interchange Optimization program has been saving CardConnect merchants an average of 0.25% – 1% per transaction! This means that even if you have the same rate quoted from a competitor, CardConnect is still the cheaper option.

Contact Us for more information on the Interchange Optimization program! Read our blog here.

Categories:: Credit Card Processing, Features