PayeezySM DCC

First Data’s Dynamic Currency Conversion service (also known as GlobalChoice) is a payment solution that allows international customers to pay in either their credit card currency or the base currency of the Merchant. The DCC service authorizes and settles transactions in major global currencies while still being funded in the Merchant’s Base Currency. Both the customer and merchant will know precisely the amount of the sale in both currencies.

With Dynamic Pricing, a consumer is offered the choice of payment currencies upon entering the merchant’s website. After selecting the preferred currency, the merchant’s website will display pricing in the chosen currency (i.e. the cardholder’s issuing bank’s currency) only. When the cardholder arrives at the checkout page, the transaction will continue to be represented in the chosen currency, through to the receipt/confirmation page. The final transaction amount will be displayed as a single currency amount in the cardholder’s selected currency.

Gateway Support

- DCC is available through the RPM’s (Real Time Payment Manager’s) POS and Recurring Transaction Screens for Retail and MOTO (Mail Order/Telephone Order) Transactions, as well as via the Hosted Checkout and Web Services API.

- DP is only available through the Hosted Checkout Page and Web Services API.

Supported Card Types

- Visa®

- Master Card®

DCC feature description

For the RPM’s VPOS (Virtual Terminal), Recurring transactions (MOTO and Retail), Hosted Checkout and Web Service API, the following functionality applies:

- The Client Base Currency is the default currency on the outlet.

- If the user’s credit card is eligible for DCC, the website displays a pop-up message offering the DCC choice to the cardholder.

- If the cardholder chooses to pay in the Client’s Base Currency, the system authorizes and settles the transaction in typical domestic fashion as is (without DCC).

- If the cardholder chooses to pay in their local currency (DCC opt in), the system authorizes the transaction as a DCC transaction in accordance with the First Data authorization specification.

- System produces a confirmation page / receipt.

Credit/Returns

If the original transaction was converted using DCC, then the credit or return must be conducted in the currency of the original sale using the prevailing rate of exchange of the date of the credit or return.

Referrals

First Data does not provide DCC authorizations via its voice authorization center; therefore a DCC transaction that has been referred must be manually authorized in the Client’s Base Currency.

DCC – Transaction Types Supported

- Purchase

- Pre-Authorizations

- Pre-Auth Completion

- Partial Auth (Transaction API Only)

- Refund

- Tagged Void

- Tagged Purchase

- Tagged Refund

- Tagged Completion

Point of Sale (POS)

The Gateway provides the ability to offer DCC via the Virtual Terminal (VPOS). This would be considered a MOTO transaction, whereby the merchant offers DCC to the cardholder over the phone. The POS will display the DCC choice to the merchant, who in turn relays the DCC choice to the customer. The merchant is prompted with all of the required DCC elements in order to make the DCC offer in a compliant manner.

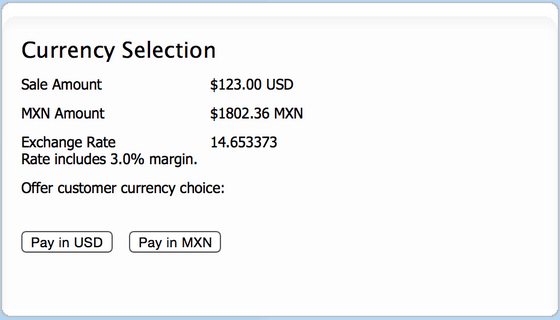

Currency Selection Pop Up

These elements are:

- Cardholder’s billing currency

- Applicable exchange rate

- Amount in the cardholder’s currency

- International margin when making the DCC offer to the cardholder

The merchant must disclose all of the following to the cardholder:

- Amount of the transaction in the Client’s Base Currency

- Amount of the transaction in the cardholder’s billing currency

- The Exchange rate used

- International margin (typically 3%, note this is dynamic and checked on every DCC request processed by the Gateway; this rate is displayed on all screens and receipts

Once the cardholder has made their currency choice, the merchant will display a Confirmation page which confirms the payment details for the cardholder. This page shows The Total Amount in the Client’s base currency and the total amount in the cardholder’s currency.

Cardholder will select the desired currency button to proceed with order. Advancing from this page initiates the authorization process.

Selecting the Cancel option will return the cardholder to the currency choice display.

This screen isn’t displayed if the cardholder selects to pay in the Clients Base Currency.

Note: This is the case when the “x_currency_code” property is sent by the merchant and it is different from the Terminal’s.

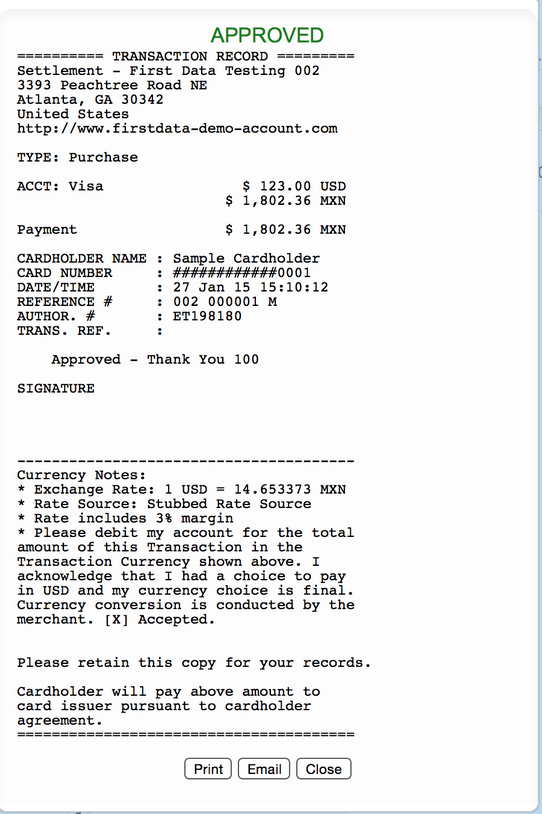

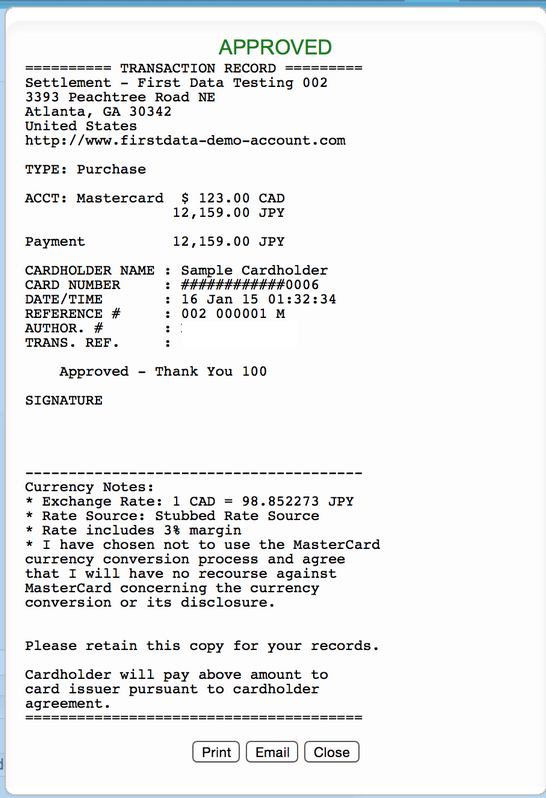

Receipt

The DCC transaction receipt will show the following:

- The Transaction amount of the goods or services in the merchant’s local Currency, also know as base currency (including the currency symbol or ISO acronym)

- The Exchange Rate used to communicate the markup applied to the DCC transaction, including any commission

- Any additional markup, commission or fee for the DCC service

- Total price in the transaction currency

- Disclosure (see example receipts below)

Example of a receipt for Visa

Example of a receipt for Master Card

Recurring Billing

For merchants that support recurring billing, This option can be enabled when the transaction is created, establishing a user profile in advance that indicates if a cardholder transaction should be converted for DCC on every recurring transaction.

This setting is determined by a onetime DCC opt-in by the customer. The merchant must notify the cardholder that they can select to have all of their transactions converted into their card billing currency, using the exchange rate applicable at the time of the transaction. If the cardholder agrees, then a flag will be set on the system that indicates this choice and drives the automatic conversion of each recurring transaction into the cardholder’s agreed billing currency.