05|2023

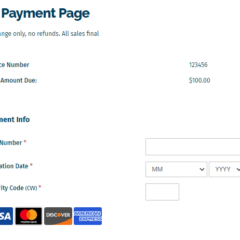

How Can a Financial Analyst Help Your Business Mitigate Credit Card Fraud?

As the digital world and technology advance, fraud and cybercrimes continue to evolve. In the US, 389,737 credit card fraud cases were reported in 2021, with losses totaling $181 million. Credit card information is also now more easily accessible thanks to sophisticated phishing scams and card skimming equipment; criminals no longer need access to the physical card… Read more »